Space exploration has always captured the attention of humanity. The pursuit to understand the cosmos, unravel its mysteries, and discover new frontiers is undeniably captivating, however, this journey is not without its challenges. The vastness of space, the harsh conditions, and the sheer distance from Earth have made space exploration a daunting endeavor.

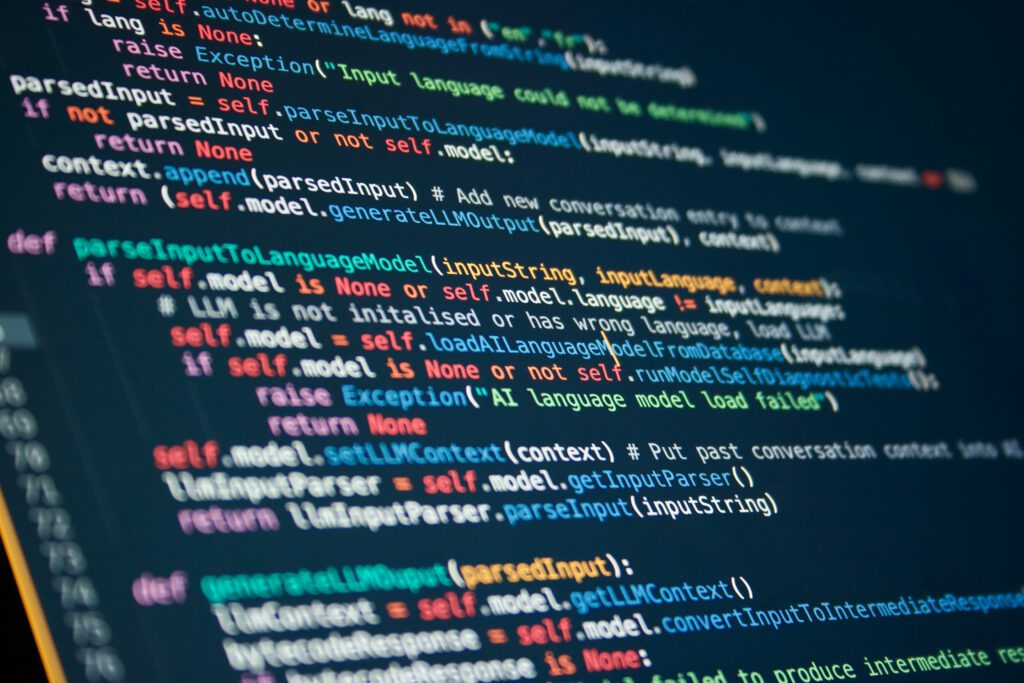

However, with the latest advancements in artificial intelligence (AI), humanity has been able to push the boundaries of what’s possible in the final frontier. From autonomous rovers to data analysis and satellite operations, artificial intelligence is helping us understand the mysteries of our universe.

In this blog post, we’ll delve into the exciting world of AI in space exploration and discover how it’s shaping the future of interstellar discovery.

5 Ways AI Is Used in Space Exploration

Autonomous Rovers

AI is playing an increasingly important role in space exploration, primarily through the deployment of autonomous vehicles. Rovers like NASA’s Curiosity and Perseverance have been executing autonomous navigation missions across the Martian terrain for years. These rovers are equipped with sensors engineered to detect environmental hazards, including rocks, craters, and various terrain features. Subsequently, an AI-driven system analyzes the data to determine the best path forward, enabling the rovers to safely savigate the Martian landscape mitigating the risk of collisions. Furthermore, NASA’s Perseverance is equipped with AI software known as Autonomous Exploration for Gathering Increased Science (AEGIS). AEGIS enables the Perseverance to collect valuable data on the different types of rocks and other Martian features that it discovers while driving Mars surface. This capability, in turn, enables us to learn more about the composition of the planet.

Satellite Operations

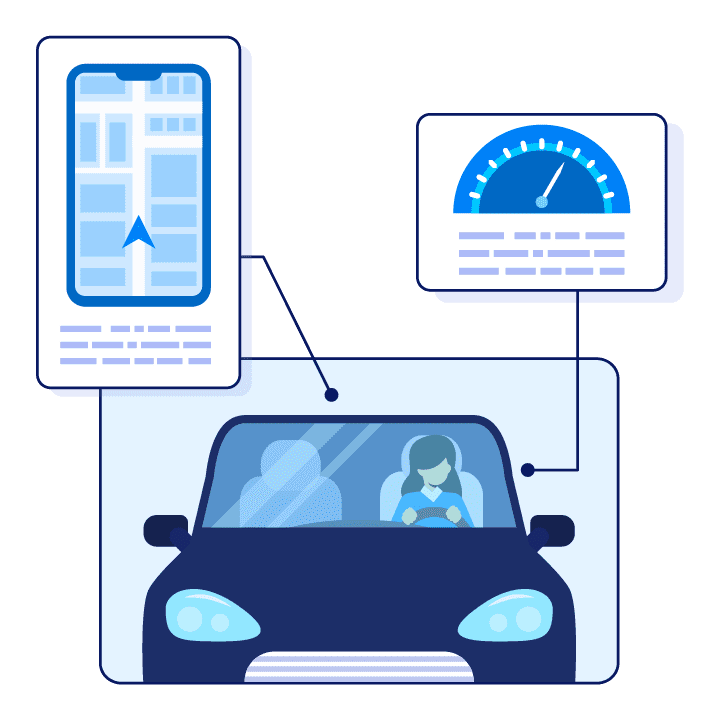

Another way AI is revolutionizing space exploration is through satellites operations. AI can provide more efficient and rapid solutions for managing satellite operations, including critical collision-avoidance maneuvers. Take, for instance, SpaceX’s Starlink satellites, which leverage an autonomous collision avoidance system driven by AI. This system is designed to detect the presence of nearby orbital debris and other hazards in real-time and swiftly take evasive actions by adjusting the speed and trajectory of the satellite. These adaptive measures ensure that the satellite safely navigates its path, avoiding any collisions that could jeopardize its mission or the safety of other space assets.

Data Analysis

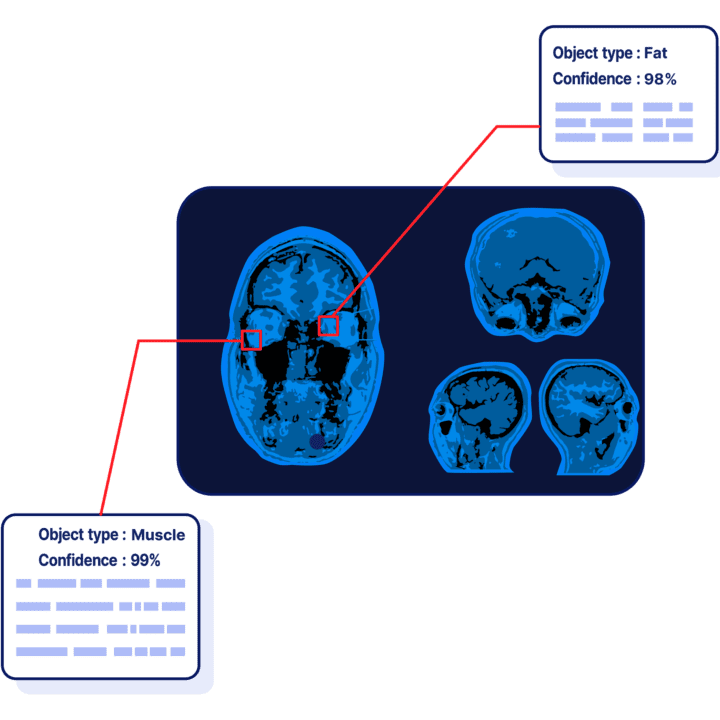

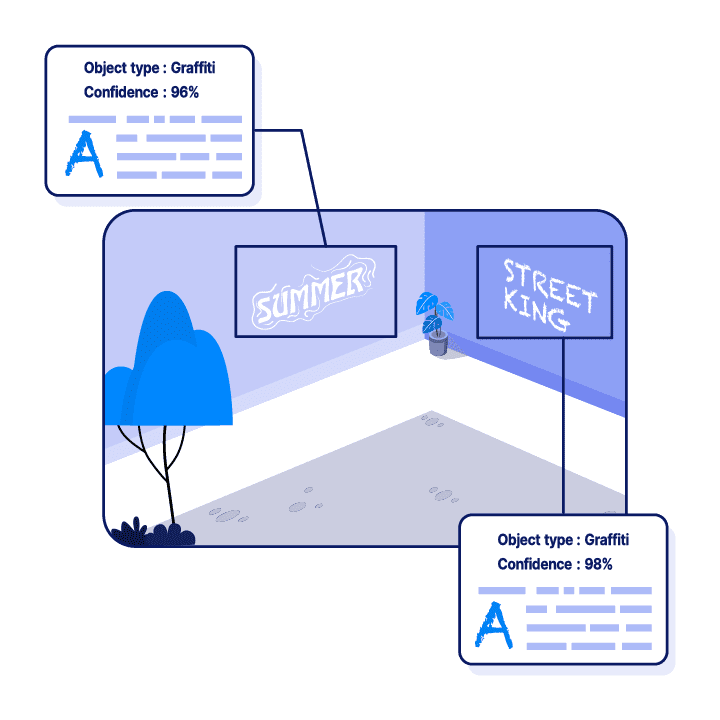

AI plays a pivotal role in data analysis within space exploration, offering more precise and efficient methods of analyzing data captured from space missions. Satellites, probes, and other space exploration tools capture and collect vast amounts of data and AI algorithms play a crucial role in analyzing and interpreting this data. Machine learning models, particularly, exhibit a remarkable ability to identify patterns, classify celestial objects, detect anomalies and even venture into the real of predictive analysis. By harnessing the power of AI, scientists can now unlock deeper insights from the cosmos and accelerate our understanding of the universe.

Rocket Landing

Rocket landing is a complex and critical aspect of space exploration. The safe and precise return of rockets to Earth or their controlled landing on other celestial bodies is essential for mission success. In recent years, the integration of artificial intelligence has significantly improved how rockets operate.

SpaceX, for instance, employs an A-driven system to analyze data from rocket’s sensors and cameras. This AI system then calculates and adjusts the rocket’s trajectory in real time, accounting for variables like wind and atmosphere, ensuring optimal landing positioning.

Galaxy Mapping

AI has ushered in a new era of precision in star and galaxy mapping, enabling astronomers to accurately identify stars and galaxies in space and even understand their physical properties (like mass and age) Through AI-based algorithms, astronomers can now detect, classify, and recognize patterns in star clusters that form distant nebulae and classify other features that are detected in deep space.

One example is NASA’s Kepler telescope which leverages AI to discern subtle dips in the light emitted by stars. These fluctuations indicate the presence of planets and help scientists identify the likely location of planets. AI’s predictive prowess can also be used to forecast the behavior of stars and galaxies over time, empowering scientists to gain invaluable insights that can be used for future mapping and exploration missions.

Conclusion

Artificial intelligence is transforming space exploration in ways previously thought impossible. It’s enabling us to venture deeper into space, gather more data, and make groundbreaking discoveries. As AI continues to evolve, we can expect even more exciting developments in the field of space exploration. Whether it’s exploring distant planets, unraveling the mysteries of black holes, or understanding the origins of our universe, AI is proving to be an invaluable tool in our quest to explore the cosmos.