How Artificial Intelligence can improve Deal Sourcing

Summary

We developed a powerful AI solution that allows private equity funds and venture capital firms to conduct the deal-sourcing process in an efficient way.

Challenge

Deal sourcing allows investors to find niche markets and assess their financial states. However, this process can be extremely time consuming and it is often aggravated by the limitations of the industry standard classification system used in the European Union. Upon registration in the Commercial Registry, every company in Germany is required to provide a description of their main business activities. However, classification systems used in the European Union such as NACE (Nomenclature of Economic Activities) don’t take into consideration new and emerging market fields within their list of codes. For instance, there is no relevant code for companies focusing on machine learning and artificial intelligence. Furthermore, searching by keywords also has its limitations, since it does not retrieve semantically relevant companies to the search query. This makes it incredibly difficult for private equity funds and business development companies to explore niche markets and find relevant companies within them.

Solution by AI Superior

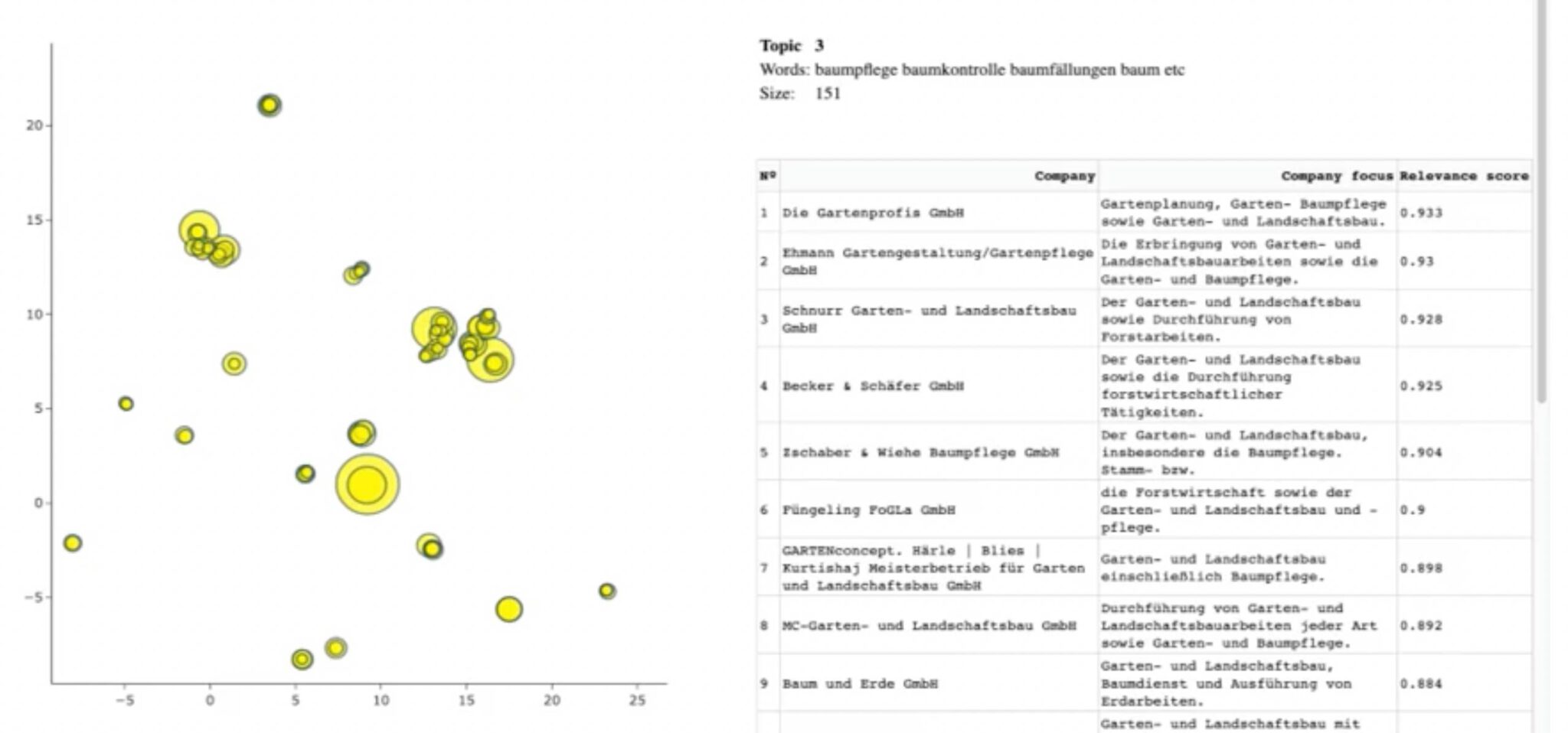

We developed an end-to-end solution based on Natural Language Processing techniques and Deep Learning models that collects, process, analyses and displays data from different sources and allows users to execute semantic and syntactic searches, explore clusters of companies, review similar companies and more.

In order to do this, our solution uses a robust scrapper to extract information from public data sources and then aggregates it into a database that contains the following fields: company name, registration date, company status (active/inactive), and commercial activity description. By employing a component that uses deep learning models so-called pre-trained networks like multilingual BERT our solution then vectorizes companies’ descriptions which enables clustering of entities based on their semantic similarity. Furthermore it also allows users to perform semantic searches by using the same approach: it vectorizes the input keyword and then searches for the semantically closest description to it in the database. The user is also able control the size of these clusters as well as define the threshold for semantic similarity. Finally, the solution also allows for financial data to be extracted and aggregated to see how relevant companies (individually or as a group) develop over time and export all this information in a pdf report.

This image shows the tool’s dashboard (the left side shows clusters of entities grouped by their semantic similarity. The right side displays the list of companies within the selected cluster)

Outcome and Implications

Our solution provided our client, a private equity company, with an advanced toolset to explore the market and get insights about specific industries. Furthermore, it allowed to increase the efficiency and optimize the deal sourcing process by reducing an analyst work load by a week for every new niche market discovered.

Besides private equity companies, our solution can be of use for other industries. For instance, it can help market analysts generate reports and analyze industry trends or help business development managers find relevant companies for their product offering, and much more.