Practical experience and theoretical background allow us to properly represent various types of heterogeneous data into ready to use machine learning data sets. We perfect the art of feature engineering for time-series data, financial transactions, spatiotemporal information, behavioral patterns and many more. A high-quality risk scoring model is one of the key success factors in risk management. Our PhD level data scientists in Machine Learning can train and properly validate a Risk Scoring Model that will have a comprehensive view of the insured.

Artificial Intelligence in Finance

Financial administrators are utilizing machine learning in finance to advance their organizations in a variety of situations, including personalized customer service, risk management, fraud detection, anti-money laundering, and regulatory compliance. This is happening across the board and in all financial services segments: capital markets, commercial banking, and personal finance.

Artificial intelligence can robotize routine undertakings by expanding process productivity, while, machine learning, deep learning, predictive analytics, and natural language processing can be used for chatbots and robots.

According to research, top managers are progressively confiding in tech and in 73% of cases, they say they trust artificial intelligence more than themselves. The use of artificial intelligence in finance can assist banks and monetary foundations with further developing client experience, lessen costs and eventually increment income.

Most common AI Use Cases

Personalized Customer Experience

By using artificial intelligence, financial organizations can obtain relevant data about their consumers' preferences and behaviours and can subsequently deliver tailored messaging, products and offers to their customers.

Customer Service

Artificial intelligence devices allow organizations and workers to save vast amounts of money and time. The implementation of AI-based programs, such as ai banking, chatbots, software for conversational assistants, robo-advisors and data analysis tools can further improve the overall customer experience.

Fraud Detection

Alternative payment methods such as contactless payment systems on smartphones and in-app payments are increasing the volumes of micro-payments both linked to credit or debit cards and through prepaid instruments. However, the convenience of online payments increases the risk of fraud on an ever-increasing scale. Fraudulent activities are fortunately now discovered with ease due to the implementation of artificial intelligence and machine learning solutions in finance and accounting.

Customer success stories

The AI Superior team developed a web application that allows users to communicate with a Custom LLM through a chatbot interface. This innovation empowers organizations to establish private, hosted

A workplace hygiene solutions company approached AI Superior with a unique task: to create a system capable of autonomously identifying when an area needed cleaning, reducing the need for

In today’s dynamic real estate market, accurately assessing the price of different zones within a city is essential for real estate professionals. However, this task has traditionally been challenging

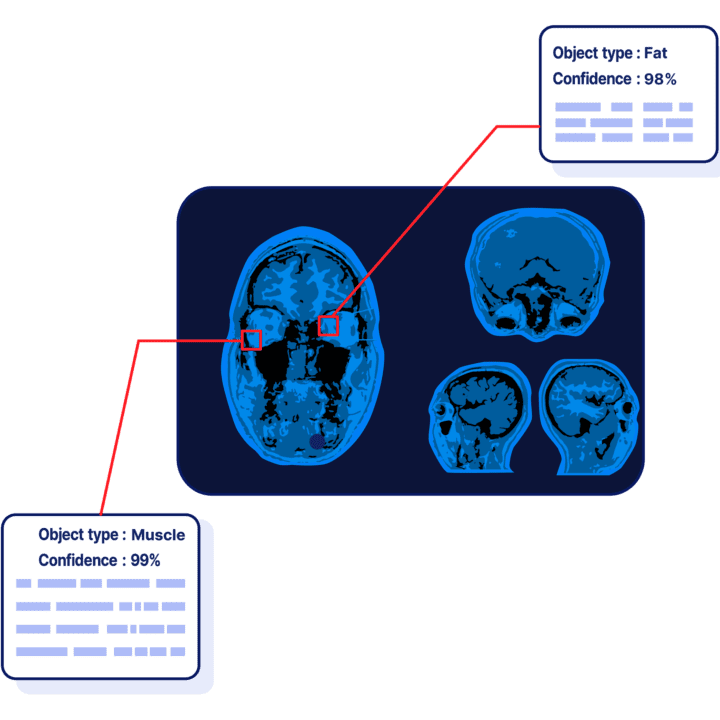

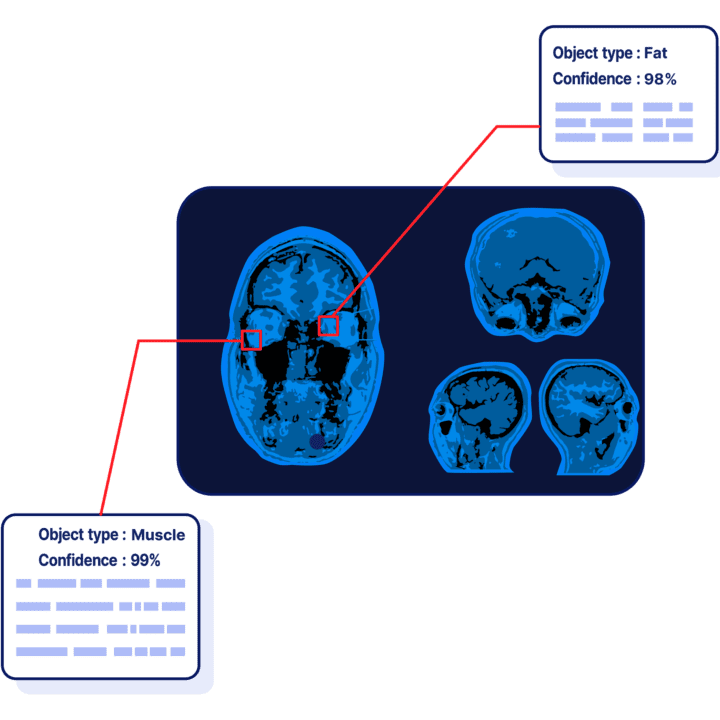

AI Superior, in collaboration with an Ophthalmology Centre, has developed an advanced deep learning model to estimate the volume of fat and muscle in human eyes using CT and

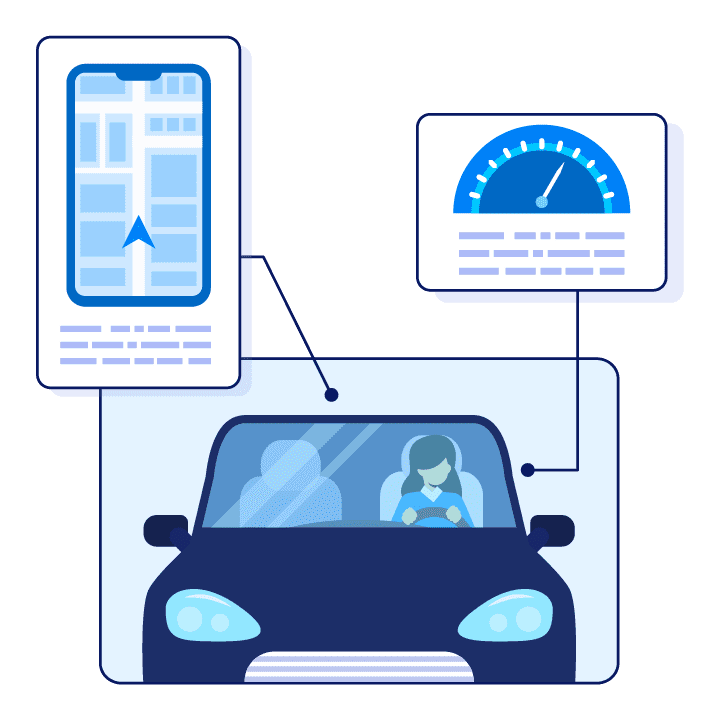

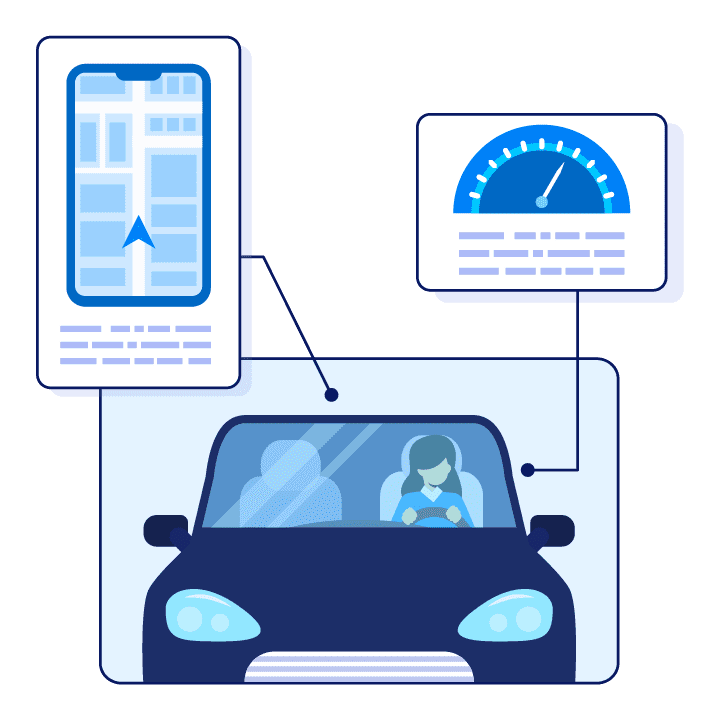

AI Superior has developed an innovative solution for an insurance company that was seeking to provide usage-based insurance to their customers. Leveraging deep learning algorithms, AI Superior has created

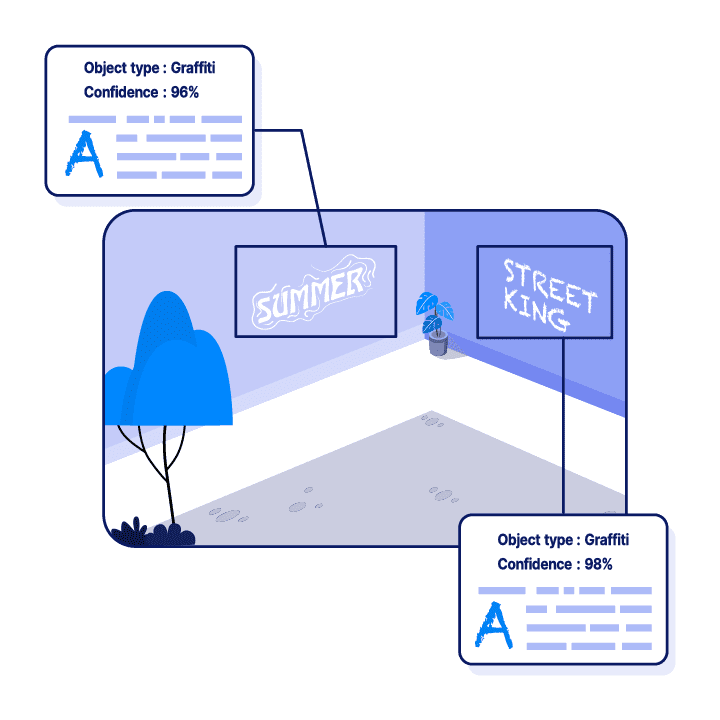

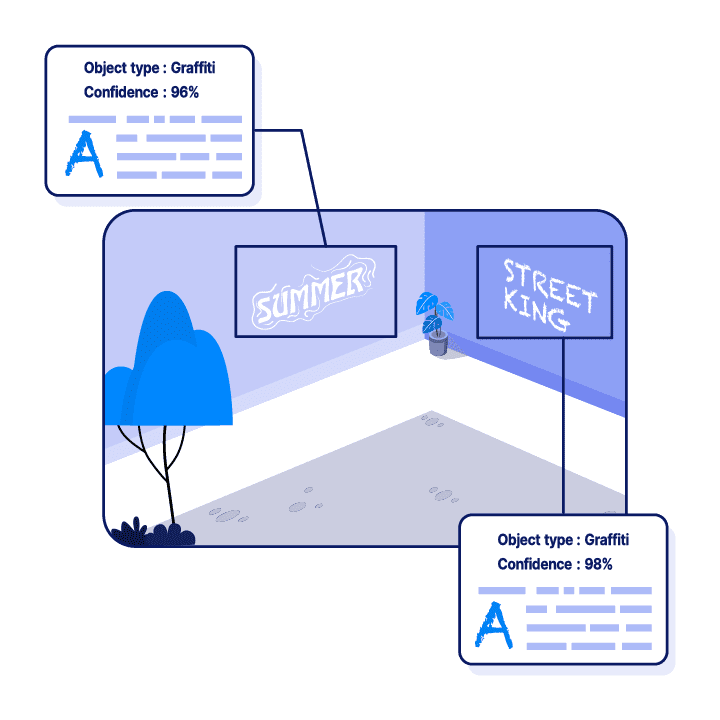

AI Superior has designed an innovative solution for municipalities to rapidly detect and localise graffiti in their cities, using state-of-the-art deep learning algorithms. This real-time, high-accuracy graffiti detection system

Our Project Approach

The AI project lifecycle has been adopted from an existing standard used in software development. Also, the approach takes into account the scientific challenges inherent in machine learning projects involving software development processes. The approach aims to ensure the quality of development. Each phase has its own goals and quality assurance criteria that must be met before initiating the next stage.

Deep Dive in Business Challenges and our AI Expertise

Are you looking for a higher number of customers and are ready to take more risk or rather to stay risk-averse and optimize the profitability with other means e.g. increasing the premium? All these relevant questions for Underwriting, Finance and Marketing can be answered with the help of Data Science by optimization algorithm to further improve the Unit Economics of your Business.

Due to a high number of variables and complexity behind modern machine learning algorithms, it is hard to interpret the reasoning and decisions made by machine learning models. AI Superior can help to overcome this issue. We can provide a tool that gives an explanation either over the whole population or for an individual customer. We work with a wide variety of methods to name a few: Neural Networks, Gradient Boosting, Random Forest.

To understand your customers behavioral patterns and risks associated with them, AI Superior offers a behavioral analysis package. Based on sophisticated machine learning models it allows you to get deeper insights into your customers behavior, segment them based on their assignment to a particular risk group and take relevant actions. A typical example of application of such an analysis is a driving style scoring where the behavior of every driver is analyzed in order to obtain driving profiles and risk of an accident associated with them. Such analysis requires telematic data obtained from an installed sensor or a smartphone. Alternatively,…

AI Superior helps to improve the predictive power of your models by providing Data Enrichment Services. It includes data enrichment and data fusion modules allowing to collect, fuse and streamline various heterogeneous data to your AI applications. This enables many use cases such as: Geospatial-based risk indices generation to explore districts and regions on the map and consume demographics, governmental statistics, public information and infrastructure-related insights Satellite imagery-based data for hazard assessment of property e.g. fallen trees or flood prediction, crises prediction and others.

Send Us a Message

Contact us to learn more about our AI solutions and how we can support your organisation in leveraging the potential of artificial intelligence

By clicking Submit, you agree to our Privacy Policy.