Core Data Science and Machine Learning

We have a robust understanding of core data science and machine learning disciplines. Forward-thinking businesses are increasingly interested in how core data science and machine learning can help propel their success in the modern age.

Tabular data is the most frequently used type of data in businesses today and with good reason. It’s easy to collate and organize data into structured rows and columns, and people intuitively know how to read this data. Tabular data has become a fundamental unit of organization for businesses. However, with so much data spanning many hundreds or even thousands of tables, extracting meaningful insights becomes a challenge. This is where machine learning and data science shines.

Put simply, a typical machine learning or core-data-science data set is a collection of observations. A time series adds a new dimension to the data, an explicit order of dependence between the data observations.

This additional information, both in terms of data constraints and structure, can be complex. Sometimes data sets can involve many different types of time series that need to be accounted for, adding to that complexity. However, for companies interested in forecasting and making predictions, factoring in time-series data is paramount for making accurate predictions.

If your company wants to obtain more actionable insights from your data, whether it’s basic tabular or time-series data, then don’t worry. We have the skills and experience necessary to bring your data to life.

What Can You Do With It?

With our expertise in core data science and machine learning, we can help businesses with goals like:

- Customer Lifetime Value prediction

- Product recommendations

- Eliminating manual data entry

- Financial analysis and forecasting

- Predictive maintenance

- Detecting spam

- Detecting fraud

- Analyzing customer churn rate

The AI Superior team developed a web application that allows users to communicate with a Custom LLM through a chatbot interface. This innovation empowers organizations to establish private, hosted

A workplace hygiene solutions company approached AI Superior with a unique task: to create a system capable of autonomously identifying when an area needed cleaning, reducing the need for

In today’s dynamic real estate market, accurately assessing the price of different zones within a city is essential for real estate professionals. However, this task has traditionally been challenging

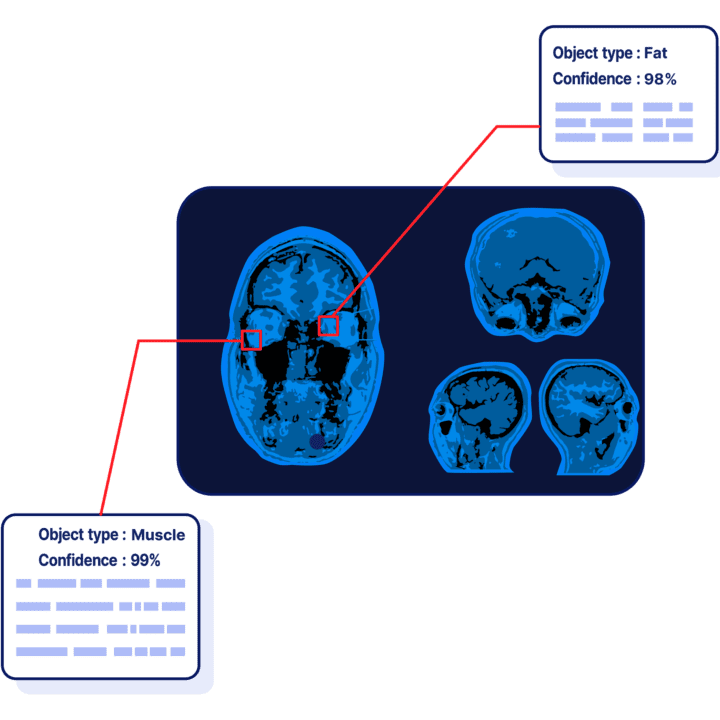

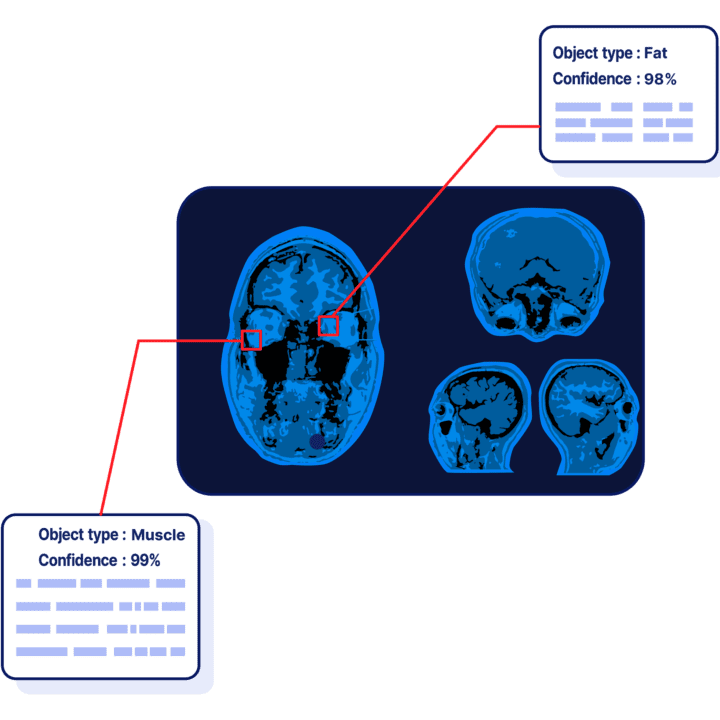

AI Superior, in collaboration with an Ophthalmology Centre, has developed an advanced deep learning model to estimate the volume of fat and muscle in human eyes using CT and

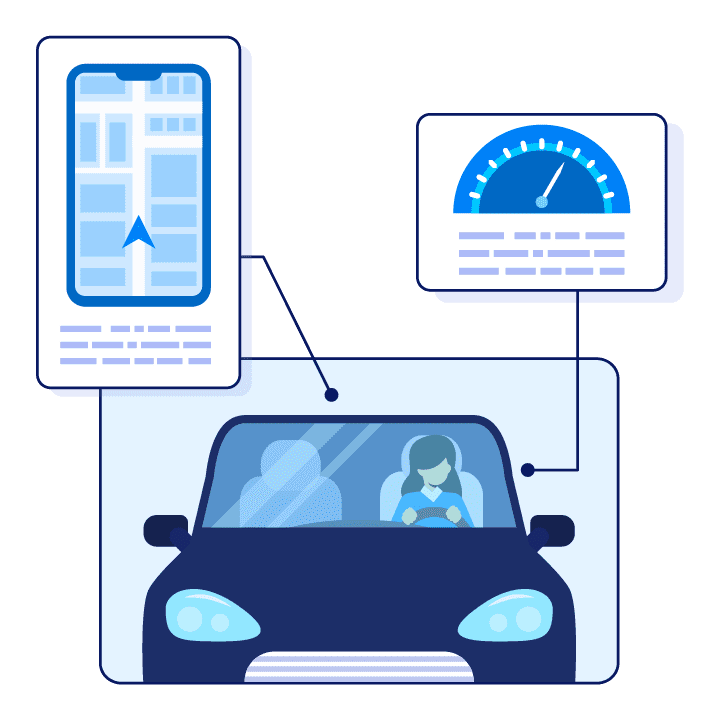

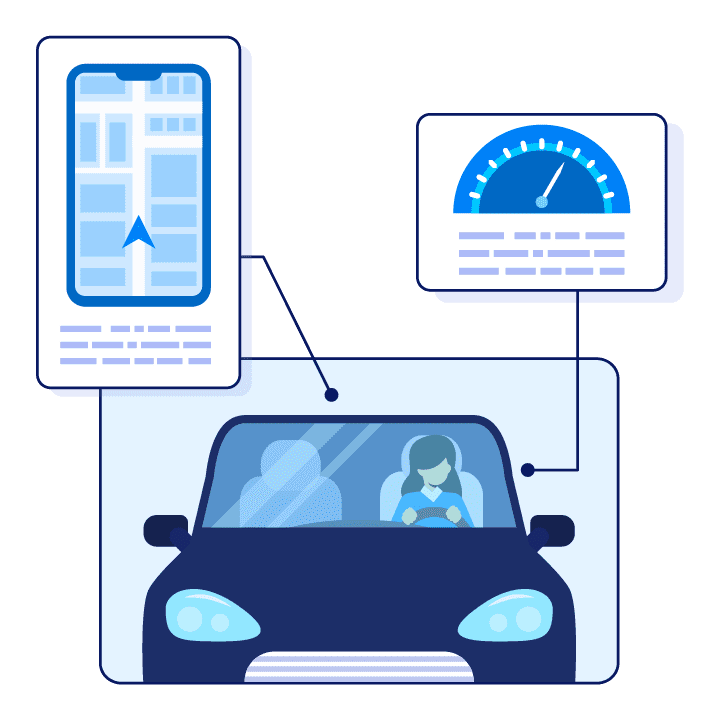

AI Superior has developed an innovative solution for an insurance company that was seeking to provide usage-based insurance to their customers. Leveraging deep learning algorithms, AI Superior has created

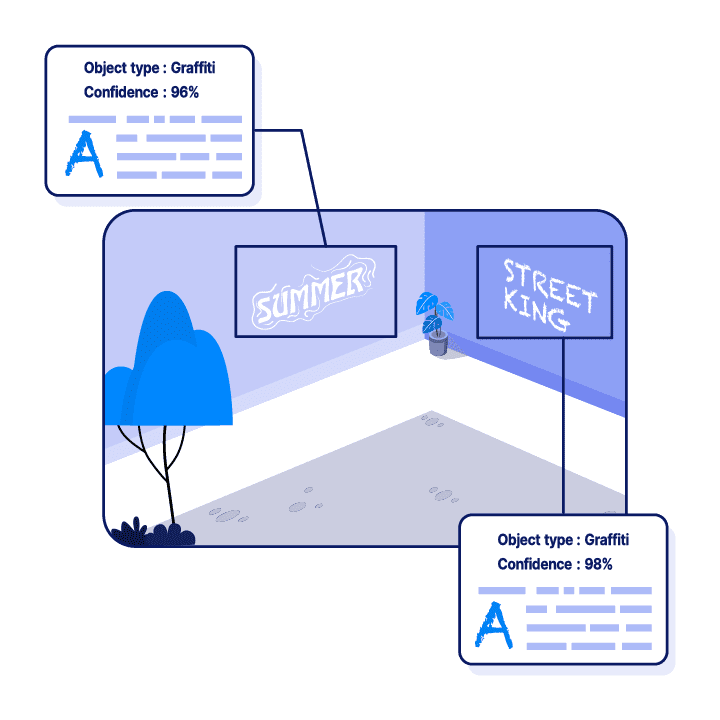

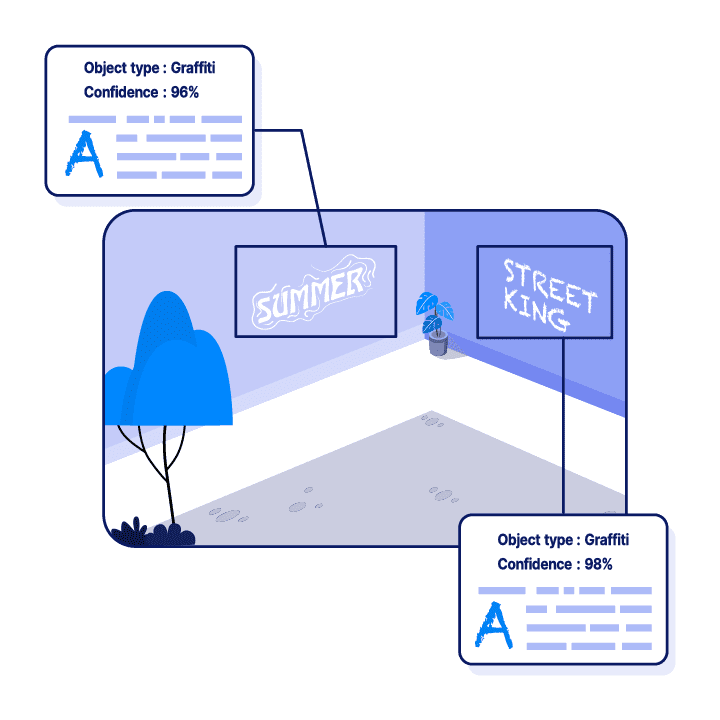

AI Superior has designed an innovative solution for municipalities to rapidly detect and localise graffiti in their cities, using state-of-the-art deep learning algorithms. This real-time, high-accuracy graffiti detection system

- +49 6151 3943489

- info@aisuperior.com

- Robert-Bosch-Str.7, 64293 Darmstadt, Germany