AI Superior is delivering Data Science Projects for customers across different industries. With the help of our Filter Criteria “Industry” and/or “Technology” you can the select the Data Science Projects which are on your highest interest. If you have further questions our Expert Team around PhD Scientist will delighted to answer your questions.

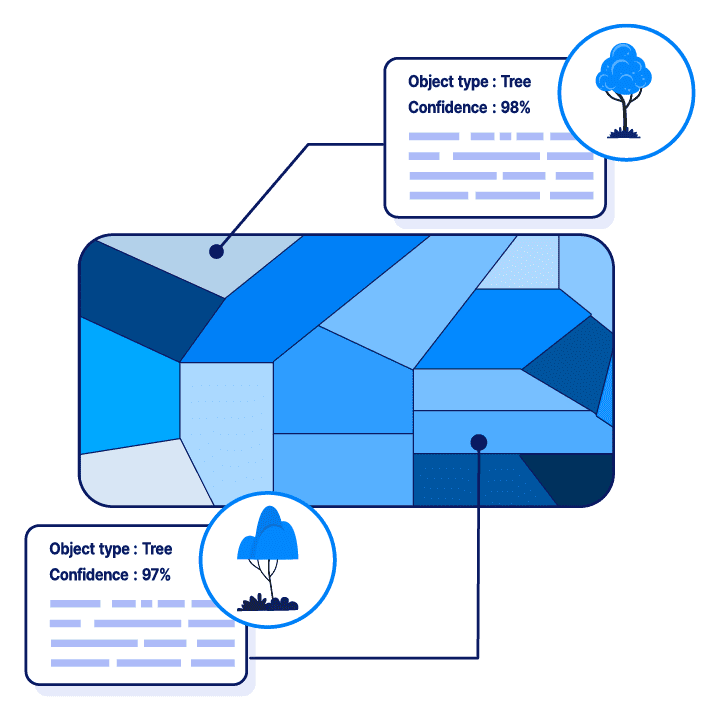

Technology

Computer Vision | Core Machine Learning

Industry

Real Estate

Potential industries

Real Estate

Client

Real Estate Online Platform

Technology

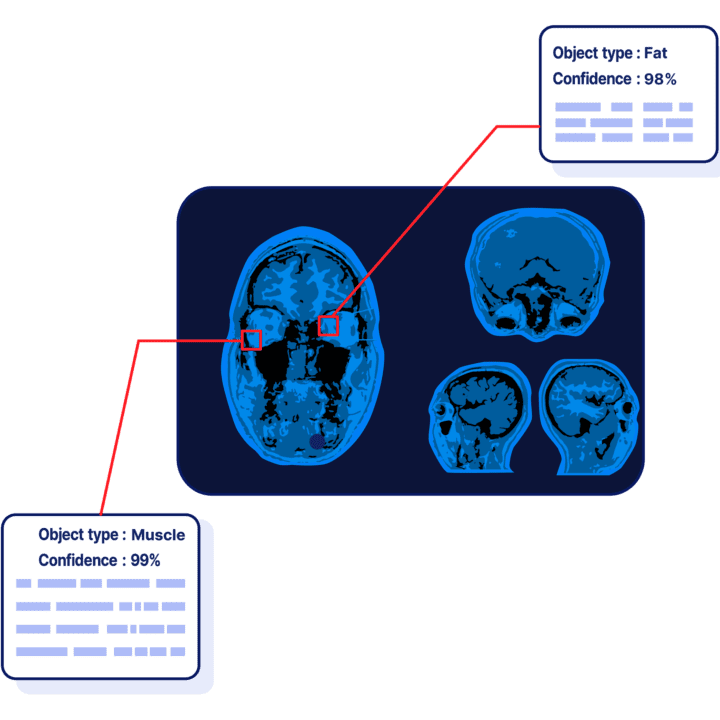

Computer Vision | Core Machine Learning

Industry

Medical

Potential industries

Healthcare

Client

Ophthalmology Centre

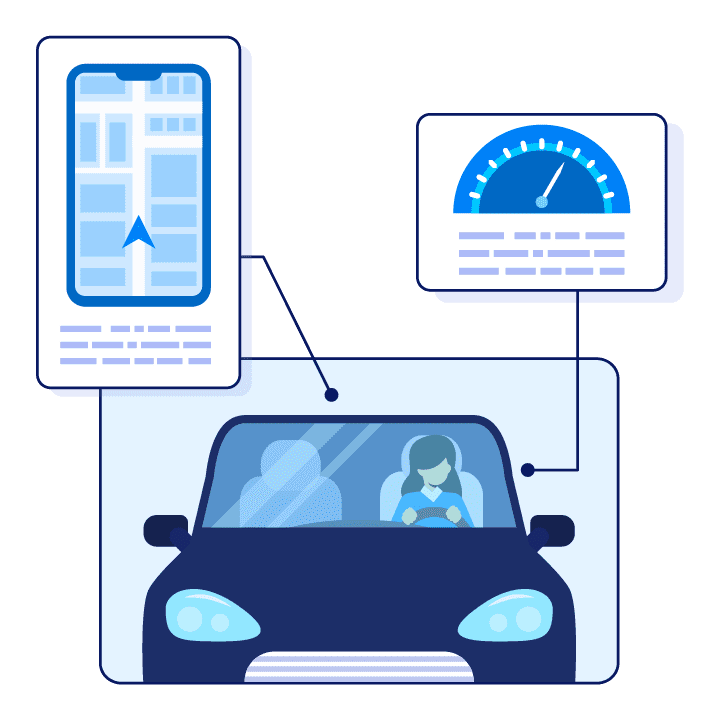

Technology

Core Machine Learning

Industry

Insurance

Potential industries

Insurance

Client

Insurance company

Technology

Core Machine Learning

Industry

NGOs, NPOs & NCOs

Potential industries

NGOs, NPOs & NCOs

Client

NGO

Technology

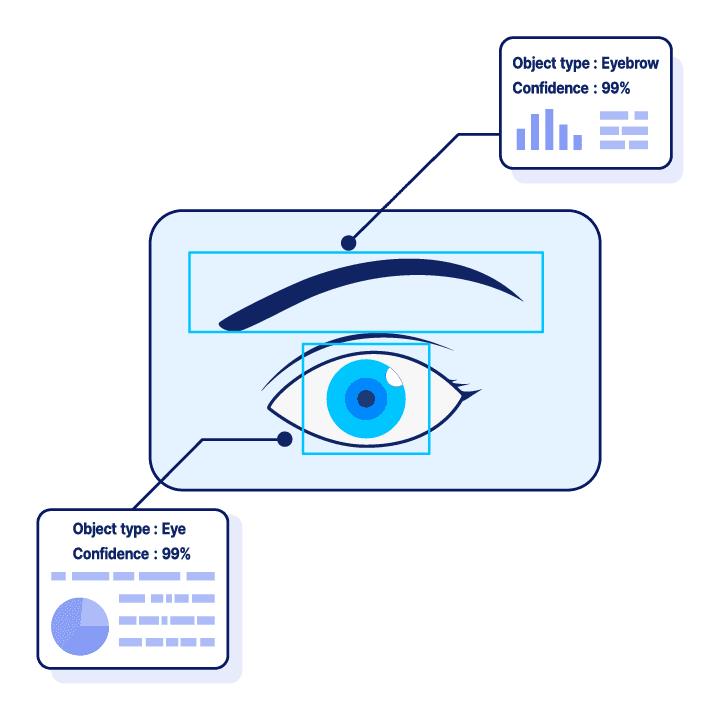

Core Machine Learning

Industry

Medical

Potential industries

Healthcare

Client

Ophthalmology Centre

Technology

Core Machine Learning

Industry

Finance

Potential industries

Finance, Banking, Insurance

Client

SME-Lending Company