Artificial Intelligence (AI) is revolutionizing the wealth management industry, offering unprecedented capabilities in handling complex financial data and improving client interactions. This article delves into various AI applications that are reshaping wealth management strategies, from automated risk assessment to personalized investment advice, highlighting their significance and potential to enhance financial services. By understanding these developments, professionals can better leverage AI technologies to optimize client outcomes and operational efficiency in the evolving financial landscape.

1. Enhanced Client Onboarding

Artificial Intelligence revolutionizes the client onboarding process in wealth management by automating critical tasks like document verification, anti-money laundering checks, and risk profiling. This automation not only speeds up the process but also enhances accuracy, reducing the risk of human error. Faster onboarding allows wealth managers to quickly access client information, significantly boosting productivity and client satisfaction by facilitating a smoother start to their financial management journey.

2. Investment Strategy Development

AI technologies are pivotal in transforming how investment strategies are formulated. By leveraging data analytics to sift through large datasets, AI identifies trends and patterns that influence market behavior, enabling wealth managers to make more informed decisions. These tools adjust investment strategies in real time, aligning them with individual investor goals and risk tolerances, thus optimizing returns and minimizing risks through more precise and dynamic portfolio management.

3. Personalized Retirement Solutions

AI greatly aids in creating personalized retirement planning solutions by analyzing an array of variables including market conditions, personal financial data, and future income estimates. By simulating different investment scenarios and outcomes, AI tools can suggest optimal investment adjustments and savings rates, helping clients achieve their retirement goals with enhanced precision. This level of customization ensures that retirement plans are robust, flexible, and tailored to individual financial needs.

4. Real-Time Fraud Detection

In wealth management, security is paramount. AI enhances fraud detection mechanisms by monitoring transaction patterns and flagging anomalies that could indicate fraudulent activities. This proactive approach allows wealth managers to act swiftly against potential threats, significantly reducing the risk of financial fraud. AI’s ability to analyze transactions in real time helps maintain the integrity of financial management processes and safeguard client assets.

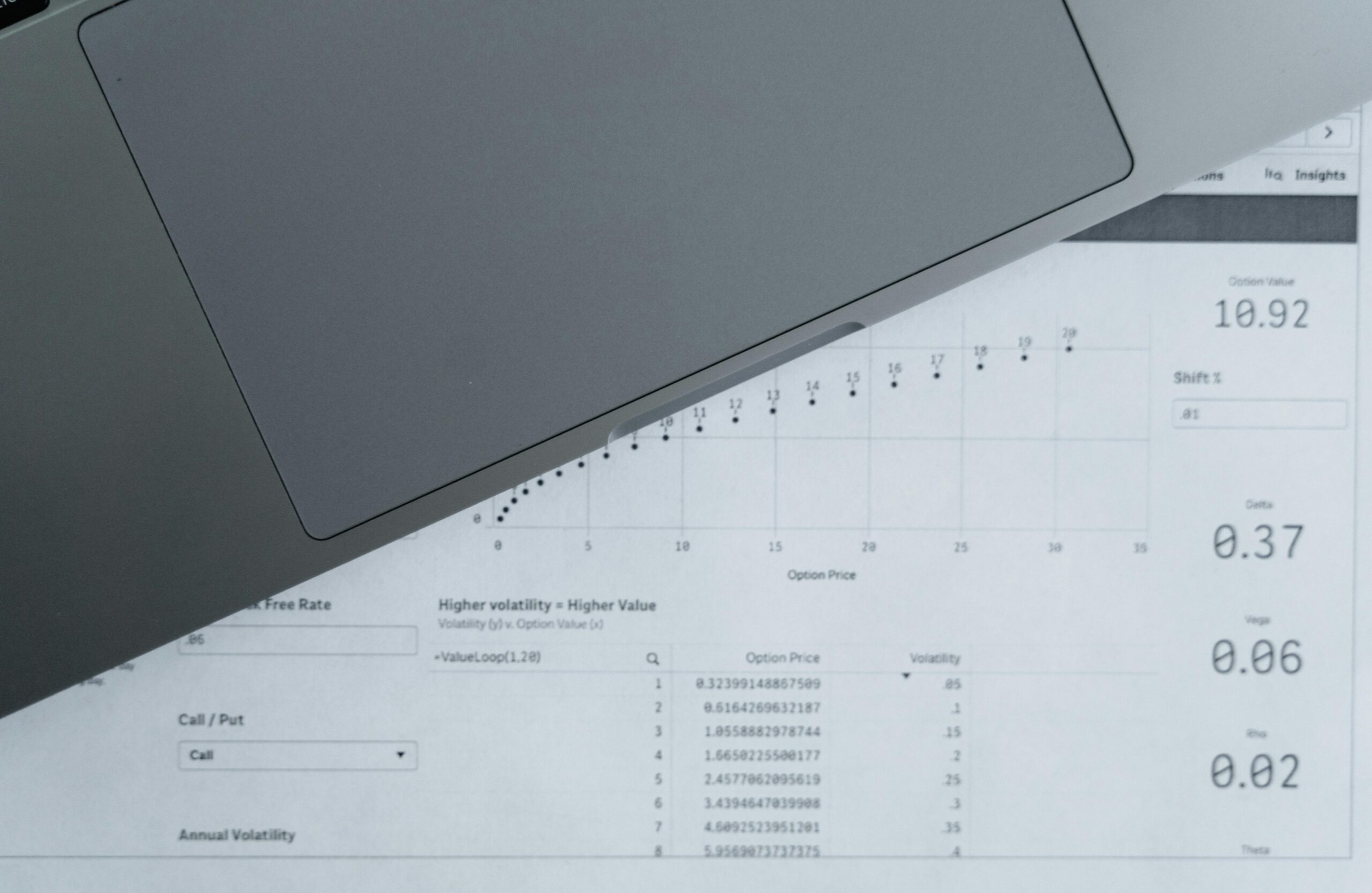

5. Dynamic Risk Assessment

AI excels in assessing and managing investment risks by employing advanced algorithms to analyze market data and predict potential downturns. These tools provide wealth managers with crucial insights into risk factors affecting various investment options, enabling them to devise strategies that mitigate risks while optimizing returns. AI’s predictive capabilities ensure that investment decisions are data-driven and aligned with both market conditions and client objectives.

6. Tax Strategy Optimization

AI simplifies tax planning in wealth management by automating the identification of tax-saving opportunities and optimizing tax strategies to align with investment goals. AI tools keep track of evolving tax laws and regulations, ensuring compliance and adapting strategies accordingly. This not only helps minimize tax liabilities but also enhances the efficiency of the tax planning process, leading to better management of investments and increased after-tax returns.

7. Custom Financial Reporting

AI transforms financial reporting in wealth management by providing customized reports that offer detailed insights into clients’ financial health and portfolio performance. These AI-generated reports analyze various metrics such as asset performance, risk exposure, and tax implications, presenting them in an understandable format. This enables clients to make well-informed decisions about their financial strategies and helps wealth managers tailor their advice to better meet individual needs.

8. ETF Portfolio Management

AI’s role in managing Exchange-Traded Funds (ETFs) involves analyzing vast amounts of market and financial data to select ETFs that best match an investor’s profile. It continuously monitors these investments to ensure they align with the client’s financial goals, adjusting the portfolio as market conditions change. This proactive management helps maintain optimal asset allocation and enhances overall investment performance.

9. Compliance Management

AI simplifies compliance management in wealth management by automating complex regulatory requirements and transaction monitoring. This technology ensures all client activities comply with financial regulations, reducing the risk of non-compliance penalties. By streamlining compliance processes, AI allows wealth managers to focus more on client service and less on administrative duties, thereby enhancing operational efficiency and client trust.

10. Predictive Analytics for Personalized Financial Insights

AI leverages predictive analytics to provide personalized financial insights that are crucial for individualized client service in wealth management. These systems analyze historical data, spending habits, and investment preferences to forecast future financial opportunities and risks. By providing these tailored insights, AI enables wealth managers to offer bespoke advice that proactively addresses clients’ future needs and adjusts to changing market conditions, ensuring optimal financial health and growth.

11. Automated Regulatory Compliance Checks

AI enhances compliance in wealth management by automating the monitoring of transactions and client activities against a backdrop of frequently changing regulations. This use of AI ensures that all operations are compliant with legal standards, significantly reducing the risk of penalties due to non-compliance. AI-driven compliance tools can quickly adapt to new regulatory requirements, providing wealth management firms with a dynamic solution that maintains high standards of compliance and operational integrity.

12. Enhanced Client Interaction Through AI-Driven Chatbots

AI-driven chatbots and virtual assistants transform client interactions in wealth management by providing immediate, 24/7 responses to client inquiries. These AI tools use natural language processing to understand and respond to questions, making interactions more engaging and informative. They can handle routine requests, freeing up human advisors to focus on more complex client needs, thus improving overall service efficiency and client satisfaction.

13. Sophisticated Risk Management with Machine Learning

Machine learning models in AI analyze vast amounts of data to identify underlying risk factors in investment portfolios. These models predict potential market shifts and recommend strategies to mitigate risks before they affect investments. This proactive risk management is crucial in maintaining portfolio health and ensuring that client investments are safeguarded against unpredictable market volatility.

14. AI-Enhanced Portfolio Rebalancing

AI automates the process of portfolio rebalancing, ensuring that investment allocations remain aligned with a client’s risk tolerance and financial goals despite market fluctuations. This AI functionality periodically adjusts portfolios to maintain desired asset distributions, which is critical for long-term investment stability and growth. Automated rebalancing helps manage risk and capitalize on market opportunities without the need for constant manual oversight.

15. Strategic Philanthropic Planning

AI in wealth management extends to philanthropic planning by analyzing clients’ financial situations alongside their charitable goals. AI tools can optimize the impact of philanthropy by suggesting tax-efficient giving strategies and simulating the long-term financial effects of charitable donations. This allows clients to fulfill their philanthropic desires while maintaining their financial health and long-term objectives.

Conclusion

As we explore the myriad of ways in which artificial intelligence is transforming the wealth management sector, it becomes clear that AI’s integration into this field is not just beneficial but essential. From enhancing the efficiency of client onboarding processes to enabling more sophisticated investment strategies and improving regulatory compliance, AI is reshaping the landscape of wealth management. The automation of tedious tasks allows wealth managers to focus on offering more strategic and personalized advice, while predictive analytics and risk management tools help in making informed decisions that safeguard client investments against potential market instabilities.

Looking ahead, the continued adoption of AI in wealth management promises further enhancements in service delivery and operational efficiency. As AI technologies evolve, they are expected to become even more integrated into the daily workflows of wealth management firms, offering deeper insights and more accurate predictions. This evolution will likely lead to an even greater personalization of client services and potentially lower costs, making wealth management more accessible to a broader audience. The key for wealth management professionals will be to remain adaptable and proactive in leveraging these technologies to meet the increasingly complex demands of their clients while navigating the ever-changing financial landscapes.