Data-Driven Insurance: Deep Learning Solution for Usage-Based Insurance

Summary

Challenge

Insurance companies have long sought to reward good driving skills by offering cheaper insurance rates. However, accurately assessing driving behaviours and providing fair discounts based on individual performance has been a challenge. Traditional methods rely on limited data and subjective assessments, leading to inconsistent results. To overcome these challenges, AI Superior set out to develop an advanced system that could process and analyze telematic data to accurately evaluate driving behaviours and calculate personalized discounts.

Solution by AI Superior

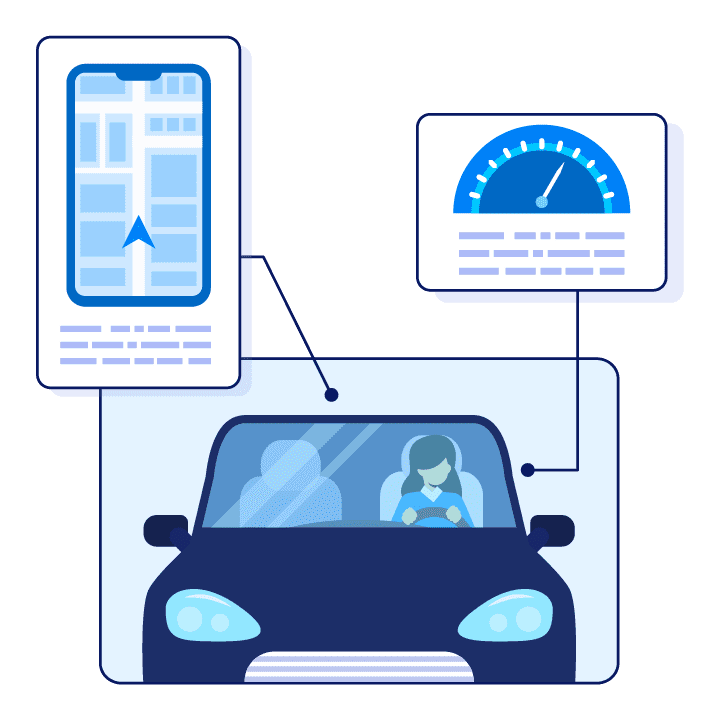

AI Superior’s solution utilized deep learning algorithms to develop a model capable of analyzing various telematic data collected from the driver’s phone. The system could analyze data from accelerometers, gyroscopes, GPS, and other sensors to detect driving modes, such as whether the user was driving or a passenger, and track driving behaviours like exceeding the speed limit, unnecessary acceleration, abrupt hard braking, and more.

A scoring algorithm was then applied to each trip to provide an overall score. Based on this score, a personal discount was calculated for each driver. Additionally, the system provided recommendations to promote safe driving practices, further incentivizing drivers to improve their performance.

Outcome and Implications

AI Superior’s usage-based insurance solution has revolutionized the way insurance companies assess driving behaviours and provide personalized discounts. By leveraging deep learning algorithms and analyzing telematic data, insurance companies can now accurately evaluate drivers and reward those with good driving skills. This approach not only benefits responsible drivers but also promotes overall road safety. By personalizing discounts based on drivers’ actual performance, insurance companies can incentivize safer driving habits and ultimately reduce the number of accidents and insurance claims.

This project is just one example of AI Superior’s commitment to transforming the insurance industry through cutting-edge AI technologies. With a track record of successful projects, including their pioneering work on Risk Management, AI Superior continues to drive innovation and shape the future of insurance.