AI Accounting Services

Our AI accounting services help businesses automate financial processes, improve accuracy, and enhance compliance. We specialize in AI-driven bookkeeping, automated expense management, fraud detection, and real-time financial reporting. Whether you need AI-powered invoice processing, predictive financial analytics, or automated tax compliance, our scalable solutions streamline accounting workflows across industries.

What Our Customers Say

Our Awards and Recognition

We are honoured to receive industry accolades for our unwavering dedication to delivering exceptional AI services and software solutions.

Endless Possibilities with AI Accounting Services

Navigation

- Endless opportunities to enhance your business

- Why work with AI Superior

- Our main AI consulting capabilities

- How we work

- Explore our customer cases

- How we implement artificial intelligence

- Our main AI technology stack & expertise

- FAQs

- Let’s discuss your next AI project

- Explore related services we are experts

Enhance Financial Efficiency with AI Accounting Solutions

AI-driven accounting solutions transform financial management by automating repetitive processes, reducing human errors, and providing real-time insights. AI-powered tools improve bookkeeping accuracy, optimize cash flow, and enhance financial forecasting. Whether managing payroll, reconciling transactions, or detecting fraud, AI accounting services help businesses maintain financial stability and compliance.

Ensure Accuracy and Compliance in Financial Processes

AI-driven accounting ensures precise data management while adhering to financial regulations. Our AI accounting solutions incorporate automated reconciliation, tax compliance monitoring, and real-time audit tracking to maintain accuracy. AI-powered fraud detection systems analyze transactional data for anomalies, preventing financial risks and ensuring regulatory compliance.

Scalable and Adaptive AI Financial Solutions

AI-powered accounting solutions must adapt to changing business needs and regulatory environments. Our AI accounting services integrate cloud-based financial platforms, predictive analytics, and machine learning to provide scalable and intelligent financial management solutions. Whether automating reporting, optimizing budgeting, or enhancing payroll management, we ensure AI-driven financial operations grow with your business.

Our success stories

The AI Superior team developed a web application that allows users to communicate with a Custom LLM through a chatbot interface. This innovation empowers organizations to establish private, hosted

Why work with AI Superior on Your AI Accounting Project

Our team includes AI specialists, financial analysts, and compliance experts who design and implement AI-driven accounting solutions tailored to various industries.

We leverage machine learning, robotic process automation (RPA), and predictive analytics to automate bookkeeping, detect anomalies, and improve financial forecasting.

Our AI accounting solutions integrate seamlessly with existing financial systems, ensuring accurate, secure, and efficient operations for businesses of all sizes.

AI-driven accounting automates complex financial workflows, optimizes reporting, and enhances fraud detection. We help businesses improve financial decision-making and compliance with AI-powered accounting solutions.

Our main AI Accounting capabilities

AI-Powered Invoice Processing

We automate invoice matching, validation, and reconciliation for seamless payment processing.

Automated Expense Management

Our AI tools categorize, validate, and optimize expense reporting for financial transparency.

AI-Driven Tax Compliance and Reporting

We ensure tax calculations, regulatory compliance, and automated tax filings are accurate.

Predictive Financial Analytics

Our AI solutions analyze historical data to forecast revenue, expenses, and cash flow trends.

Automated Payroll Processing

AI streamlines payroll calculations, deductions, and tax withholdings for accurate employee payments.

Our AI Accounting leadership team

Discovery stage:

We assess business accounting requirements, define AI integration strategies, and identify automation opportunities for financial operations.

Initial setup:

We configure AI accounting models, integrate data sources, and establish AI-driven financial workflows to optimize efficiency.

Building MVP:

We develop a Minimum Viable Product (MVP) to test AI-powered financial automation, refine predictive models, and optimize reporting accuracy.

Scaling and integrating:

Once validated, we scale AI accounting models, integrate with financial software, and enhance automation for seamless financial management.

Evaluating results:

We continuously monitor AI accounting performance, fine-tune models, and refine financial automation strategies for maximum efficiency.

Explore our customer cases

How we implement AI Accounting Solutions across multiple industries

We help insurance companies integrate AI-powered accounting to streamline financial reporting, detect fraud, and optimize claims processing.

- AI-powered financial reconciliation for automated claims processing

- AI-driven fraud detection in insurance transactions

- Automated expense tracking and premium calculations

We enhance financial management in the construction industry by automating cost tracking, budgeting, and payroll processing.

- AI-driven project cost estimation and budget management

- Automated expense tracking for construction materials and labor

- AI-powered payroll processing for construction workforce

We implement AI-driven accounting automation to improve financial reporting, investment analysis, and fraud prevention in financial institutions.

- AI-powered risk assessment models for financial transactions

- Automated fraud detection and anomaly tracking

- AI-driven reconciliation and compliance automation

We assist government agencies in automating financial processes, ensuring compliance, and optimizing public budgeting.

- AI-powered public fund allocation and expense tracking

- Automated tax compliance and regulatory reporting

- AI-driven financial auditing and fraud detection

We help startups optimize financial workflows by automating bookkeeping, expense management, and financial forecasting.

- AI-powered revenue and expense tracking for startups

- Automated invoice processing and tax calculations

- AI-driven financial forecasting and budget optimization

We streamline financial operations in the media industry by automating royalty payments, ad revenue tracking, and financial reporting.

- AI-powered advertising revenue and royalty payment tracking

- Automated accounting for subscription-based media services

- AI-driven financial planning and budget forecasting for content production

We optimize financial accounting in the oil and gas industry by automating asset tracking, cost analysis, and risk management.

- AI-driven expense tracking for resource exploration and operations

- Automated financial reporting for regulatory compliance

- AI-powered risk assessment for energy market investments

We integrate AI accounting solutions to automate financial management in pharmaceuticals, from drug research funding to operational cost tracking.

- AI-powered cost optimization for drug research and development

- Automated financial compliance and audit tracking

- AI-driven revenue forecasting for pharmaceutical sales

We provide AI-driven accounting solutions for real estate businesses to automate lease management, transaction reconciliation, and tax filing.

- AI-powered property valuation and financial forecasting

- Automated rent and mortgage payment processing

- AI-driven tax calculations for real estate transactions

We assist space research organizations with AI-powered financial management, optimizing research budgets, operational expenses, and funding distribution.

- AI-driven expense tracking for space missions and research projects

- Automated budget allocation for government and private funding

- AI-powered financial risk analysis for space industry investments

We support nonprofit organizations in optimizing financial transparency, automating grant management, and ensuring compliance with funding regulations.

- AI-powered donor fund allocation and financial reporting

- Automated expense tracking and budget forecasting

- AI-driven compliance monitoring for nonprofit financial management

Our main AI technology stack and expertise

We work with all major databases and frameworks within the AI ecosystem, including PySpark, PyTorch, Hadoop, and TensorFlow. Our team of AI consultants are experts in various fields and applications of AI, including:

- Big data analytics

- Natural language processing (NLP)

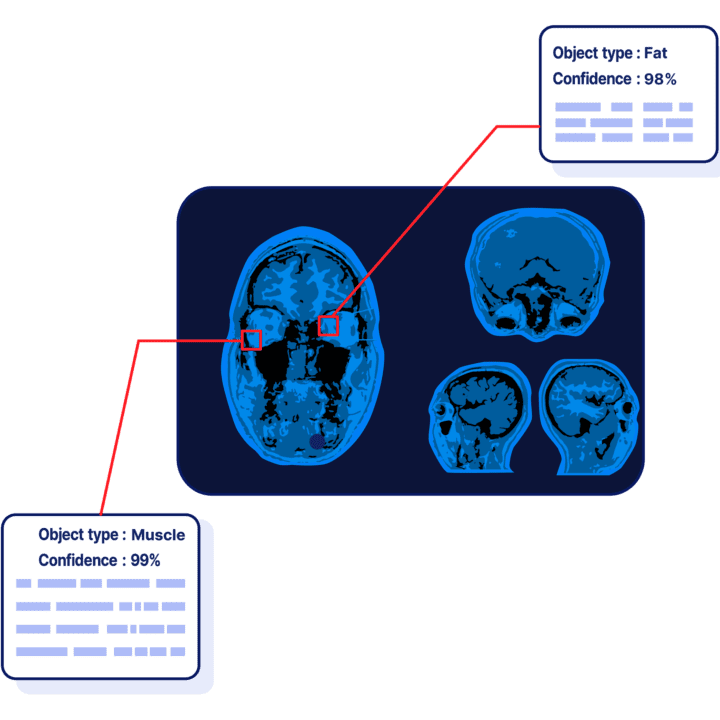

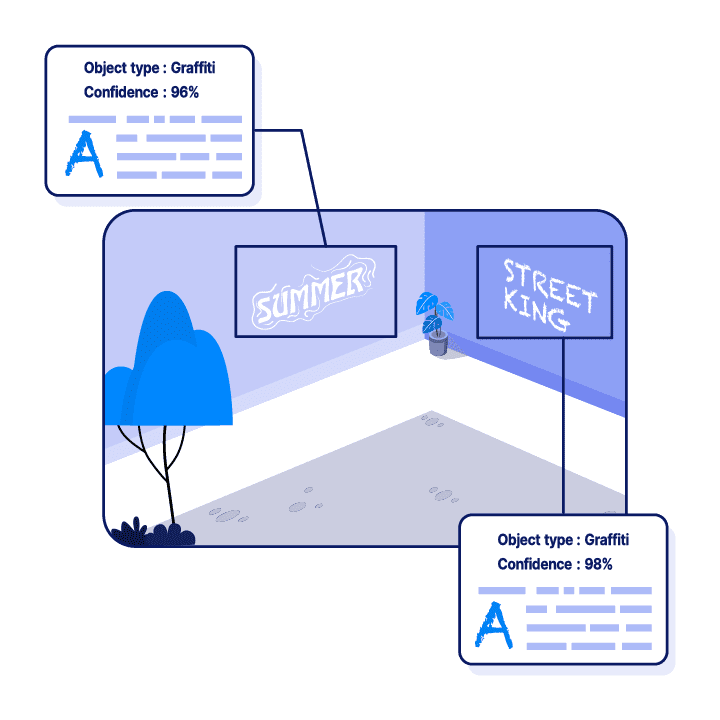

- Computer vision & image processing

- Predictive analytics

- BI solutions

FAQs

What are AI accounting services?

AI accounting services involve using artificial intelligence to automate bookkeeping, financial reporting, tax compliance, and fraud detection. These solutions help businesses streamline accounting processes, reduce human error, and improve financial decision-making.

How can AI improve financial accuracy?

AI-powered accounting software can analyze large volumes of financial data, detect anomalies, and ensure compliance with accounting standards. AI reduces manual data entry errors, automates reconciliations, and generates accurate financial statements.

Can AI accounting systems integrate with existing financial software?

Yes, AI accounting solutions can be integrated with existing financial platforms, including ERP systems, tax software, and payroll systems. This ensures a seamless workflow, allowing businesses to enhance their financial management without disrupting operations.

How does AI help with tax compliance?

AI automates tax calculations, applies the latest tax regulations, and generates accurate tax reports. AI-powered tax compliance tools reduce the risk of errors, minimize tax penalties, and optimize tax deductions for businesses.

Can AI detect financial fraud?

Yes, AI-driven fraud detection systems analyze financial transactions in real-time, identifying suspicious activity, unusual patterns, and potential fraud risks. Machine learning algorithms continuously adapt to new fraud tactics, improving security and compliance.

Is AI accounting suitable for small businesses?

Absolutely. AI accounting solutions can be tailored to businesses of all sizes. Small businesses benefit from automated bookkeeping, real-time expense tracking, and AI-driven tax filing, allowing them to manage finances efficiently with fewer resources.

How does AI help with cash flow management?

AI analyzes past and current financial data to predict cash flow trends, helping businesses manage expenses, plan for future investments, and prevent liquidity shortages. AI-driven insights enable smarter financial decision-making.

- +49 6151 3943489

- info@aisuperior.com

- Robert-Bosch-Str.7, 64293 Darmstadt, Germany